4 Points to Consider When Choosing the Best Medicare Supplement

If you want to fill the “gap” created by the Original Medicare plan, you can choose the right Medicare supplement plan. This is why it’s also known as Medigap insurance. Private insurance businesses provide these types of insurance plans.

These policies are designed to cover things like copayments, coinsurance, and deductibles, to mention a few. We’ve provided some easy guidelines in this post to assist you in selecting the right plan and supplements such as Best DIM Supplements and the best garlic supplements to meet your needs.

Continue reading to learn more.

1. Find out what plans are available in your state

First and foremost, please remember that each of the plans remain standard, meaning they all provide the same degree of protection. However, insurance companies are free to choose which policies they want to offer. For instance, an insurance company may decide to provide two to three different policies in different states.

As a result, you should conduct your investigation and compare various policies. To narrow down your possibilities, you should start with your city and zip code.

2. Learn everything there is to know about the plans.

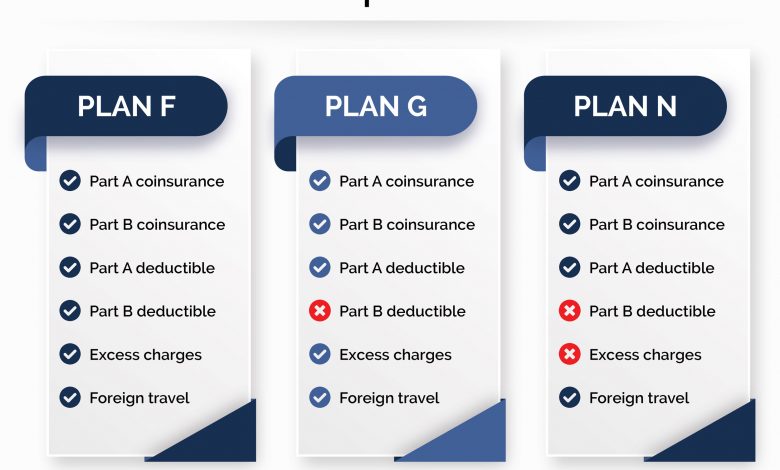

Second, each Medicare Supplement plan covers a different set of services. As a result, you may want to familiarize yourself with all of the plans. Going with a plan that demands lesser monthly charges is not a good option.

If you don’t mind having less coverage, you can choose for the plan that doesn’t come with higher insurance prices.

3. Select a Level of Coverage

After you’ve familiarized yourself with the various varieties of plants, think about your budget and the quantity of coverage you require. It’s crucial to remember that if you decide to alter your plan in the next few years, you can be subject to underwriting. So, think about a plan that you can keep to till you retire.

4. Obtain Multiple Estimates

We recommend getting quotations on your desired plans after you’ve decided on the plans and the degree of coverage you require. You won’t have to worry about drawing any comparisons in this situation because the coverage levels are all the same.

What you need to do now is collect as many quotations as possible to help you make an informed decision. You should input your zip code and other details so that you may get bids for the plan you want.

You can sort the results using the filter to display them in ascending or descending order. It displays two premium quotes. And one of the quotes is without a household discount, while the other includes one.

The good news is that most insurance companies provide family discounts to encourage families to purchase several policies. You can save up to 12% by signing up for a household discounts plan.

The Remainder

To cut a long tale short, if you want to find the best Medicare Supplement plan for your circumstances, we recommend that you follow these four guidelines. Hopefully, this information will assist you in getting started and selecting the best plan for you.

Always ensure you get the right supplements from a trusted source. This is because if your supplements have any issue, are expired, don’t provide the required nutrients that will be problematic from you. Also, do check out the reviews for the leading supplements such as best DHEA supplement, Best GABA Supplements, and more. Be sure that you get the right supplements for your problems and are able to recover from the issues you are facing.

EMedicareGuide is a good place to go if you want to look at Medicare Supplement plans. They provide helpful resources for people like you who are looking for information. As a result, you can utilise their recommendations to choose the finest Medicare Supplement plan g.

https://articlesfit.com/category/health-and-fitness/