To be prosperous, either you trade forex or invest in the stock market, you must make sound trade selections. A variety of useful indicators, in addition to a decent trading platform, is critical for your performance. Indicators, without a question, assist you in reading a trading chart and determining whether the market is ranging or trending. Clients can also use analytical indicators to determine when a product has been overbought, oversold, or is due for a turnaround. In this article, we will go through one of the most commonly used technical indicators (KDJ).

What is a KDJ indicator?

KDJ is a useful metric that assists traders in forecasting stock movements and variations in price movements. It is also known as a random index. Traders primarily utilize it to do short-term analysis. It not only helps you identify trend direction, but it also helps you find optimum points of entry.

In addition to the three lines K, D, and J, the KDJ indicator has two price levels: maximum and minimum. In order to calculate the timeframe, the indicator considers both price levels as well as the amplitude of fluctuating prices. As a result, the indicator is thought to properly represent price variations. The quickest index in the KDJ index is K in yellow, the slowest index is D in blue, and J is the midrange index with a demarcation signal.

The KDJ index values for K and D vary from 0 to 100, whereas the value for J might be less than 0 or greater than 100. Therefore, for study and analysis, the software incorporates KDJ values ranging from 0 to 100. The value for J is more sensitive than the value for K, and the value for D is the least sensitive. D, but at the other end, has greater stability, whereas K and J values rank at 1 and 2, suggesting that the latter is less reliable.

Investors use the KDJ indicator to try to comprehend the link between the maximum, minimum, and final values of an underlying asset. It also makes use of the attributes of the strength indicator, the impetus idea, and the moving average. As a result, judging market dynamics with the KDJ indicator becomes quite simple.

How does it function?

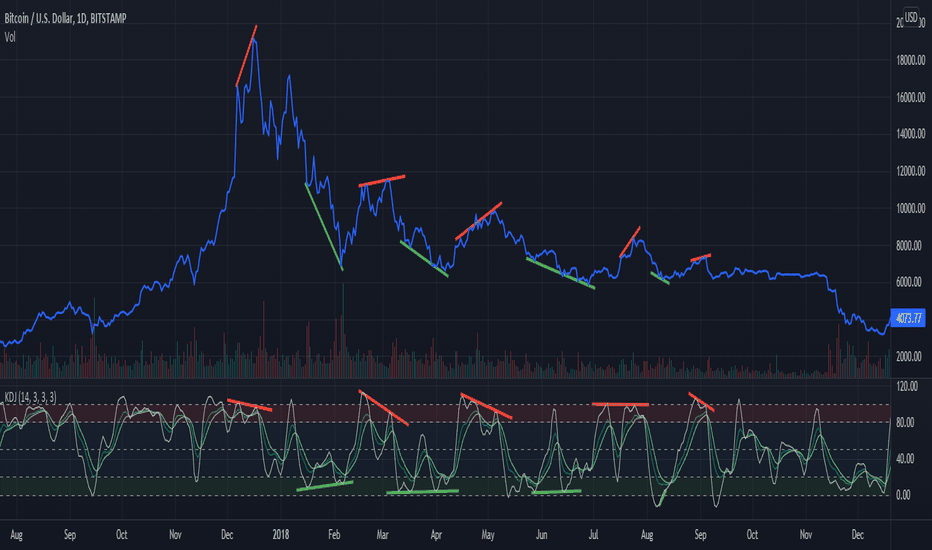

The KDJ signal identifies arbitrary changes in prices and is best used for short and medium-term analysis in a moving market. However, at a longer time period, the K-line chart predicts the price trend quite effectively. On the weekly chart, for example, the KDJ indicator’s mid-line action performs significantly better.

Although the K and D lines resemble those used in the Stochastic Oscillator, the J-line indicates the divergence of D’s values from K. When these levels cross, you can expect a new potential chance.

Configuring the KDJ Indicator

The KDJ Indicator is a measurement tool that uses past data to make predictions. Clients can use KDJ to identify underlying trends and insights in changes in the value that a human eye would find harder to identify. Traders must modify their activities in relation to the KDJ indicator’s findings.

The easy procedures for configuring the indicator are listed below.

- Download and install the KDJ MT4/MT5 Indicator on your PC. It is easily found on the internet.

- Upon installing it, login in to the MetaTrader platform and enter the data folder by selecting it from the menu bar.

- Navigate to the MQL4 file and copy it to the indicators section.

- Start the Metatrader 4/5 Client again.

- To place the KDJ indicator to the trial, select a chart and timeframe.

How should the KDJ indicator be used in trading?

Traders use KDJ indicators primarily to seek for buy and sell indications. There are 3 distinct zones centered on the KDJ indicator values: oversold, overbought, and meandering. When the value of KDJ falls below 20, it enters an oversold zone. Likewise, numbers above 80 enter the overbought region.

Whenever the three lines connect above an overbought level, the KDJ indicator generates a sell signal. In this case, the blue line stays on top, while the yellow line moves to the center and the red line stays at the base. A purchase indication is also generated when all three lines converge underneath an oversold level in the same phase.

Not to remark, if the KDJ indicator values are between 20 and 80, you should wait for the confirmatory message. Overbought and oversold levels signal reversal chances. While the attribute values for these levels are 80 and 20, you can adjust them for more responsiveness to get a more accurate assessment.

Concerns When Using the KDJ Indicator

It is advisable to combine the KDJ indicator with other metrics such as the Average True Range (ATR) and the Average Directional Index (ADI). The Average Directional Index (ADX) suggests a potential shift to the left. Because KDJ is less likely to conduct in inherently unstable markets, ATR can give you a better idea of market volatility with some degree of certainty.

The Benefits and Drawbacks of the KDJ Indicator

KDJ, like other indices, has various advantages and disadvantages, which are outlined below.

Advantages

- The KDJ indicator is simple to use and decipher.

- It is most effective when combined with other metrics such as Stochastic Oscillators.

- It is great for detecting price patterns and determining the best points of entry.

Disadvantages

- In a volatile market, the KDJ indicator does not work.

- It occasionally provides misinformation.

Conclusion

The KDJ indicator is very useful for determining trends and identifying access points. Nevertheless, the signal, like any other technical indicator, can occasionally produce erroneous data and should not be depended on in absolute terms. It is preferable to combine it with other technical indicators in order to make more informed trading decisions.

If you’re a dealer in need of funds, look into the financing alternatives provided by Traders Hub and select an adequate solution for you, whether it’s the challenge model or instant financing, based on your preferences. This will relieve the strain of needing to convert accounts quickly and allow you to focus solely on your trade skill.